I thought I was done with BestSelf. I built the company from zero to over $45 million in sales over seven years. I put sweat, blood, and tears into it, and then made the difficult decision to sell in October 2022 to a barely established private equity company.

But sometimes life pulls you back to unfinished business — and I bought it back 14 months later for pennies on the dollar.

One hundred days ago, I found myself back at BestSelf. The company had lost its way under new private equity ownership. It was like walking into a house you once called home, only to find that the new owners had completely changed everything. The BestSelf I built was unrecognizable, and the team was gone too. The focus had shifted from our core strengths to chasing short-term gains on Amazon, sacrificing what made us successful in the first place. The charm was gone.

But I'm not one to back down from a good challenge. I knew that beneath the surface, the heart of BestSelf still beat strong. It was time to roll up my sleeves, get back to basics, and rebuild the company I loved.Identifying Problems

The best way to move forward is to figure out what went wrong and what they did right. Here's how I think they went wrong.

Focus on Amazon → sacrificing DTC

When I sold the business, we were 60% direct-to-consumer and 40% Amazon. Now it's 75% Amazon. The private equity firm shifted the brand from direct-to-consumer to an Amazon-focused approach, possibly due to hiring ex-Amazon employees unfamiliar with DTC.

You need more skills and resources for DTC, but it's a more profitable channel. You own your customer and can re-market to them anytime. Amazon is less profitable due to ever-increasing fees, especially over the last year.

When I sold, our main products were on Amazon, but the private equity firm decided to send everything we sold on BestSelf to Amazon FBA. This was a mistake.

Only tier A products should be on Amazon, while tier B and C products should stay on your store. (More on how I think of tiers here.)

This channel shift wasn't as profitable since slower-moving items would be better suited for building lifetime value or add-to-cart purchases rather than sitting in an FBA warehouse accruing long-term storage fees.

Ownership and oversight

The truth is, no one will care more about your business than you will as the founder. Especially when you're bootstrapped and counting every dollar. Coming back, I found a general lack of care where things had fallen through the cracks or been completely neglected.

While the private equity firm had huge purse strings, they lacked attention to detail and digging into issues. Rather than throwing money at problems, they needed someone to sit down and give them focused thought and attention.

For example, the private equity firm spent a lot of money managing the Amazon channel. They had 1-2 internal staff members and paid a PPC ads agency $15-20k a month. Yet there were fundamental mistakes being made. This monthly fee might have been based on a percentage of revenue from sales as it varied monthly.

For example, the private equity firm spent a lot of money managing the Amazon channel. They had 1-2 internal staff members and paid a PPC ads agency $15-20k a month. Yet there were fundamental mistakes being made.

(This monthly fee might have been based on a percentage of gross revenue from sales as it varied monthly.)

I don't like this percentage-based pricing model because it creates misaligned incentives. If you get paid based on gross revenue, then you're incentivized to grow revenue even if it becomes unprofitable.

This is the reason many investor-funded DTC companies and aggregators are failing. Interest rates are up, making the free money they spent for growth more expensive to borrow, especially when you’re burning through it unprofitably.

Another issue with this agency is their use of AI for running ads without human oversight to ensure profitability. Many ads weren't profitable, even before all the fees.

Amazon Hijackers & Counterfeit Issues

Another issue I found was with their Amazon listing being over run by hijackers.

Many people don't realize that on Amazon, the product listing is owned by Amazon, not the brand. It's difficult for brands to protect themselves, even with trademarks.

More detail on how this works below:

Real vs Fake — Navigating amazons minefield of counterfeit goods.

— Cathryn (@cathrynlavery) March 5, 2024

What a racket 💀💀💀 pic.twitter.com/1NAJoxmypu

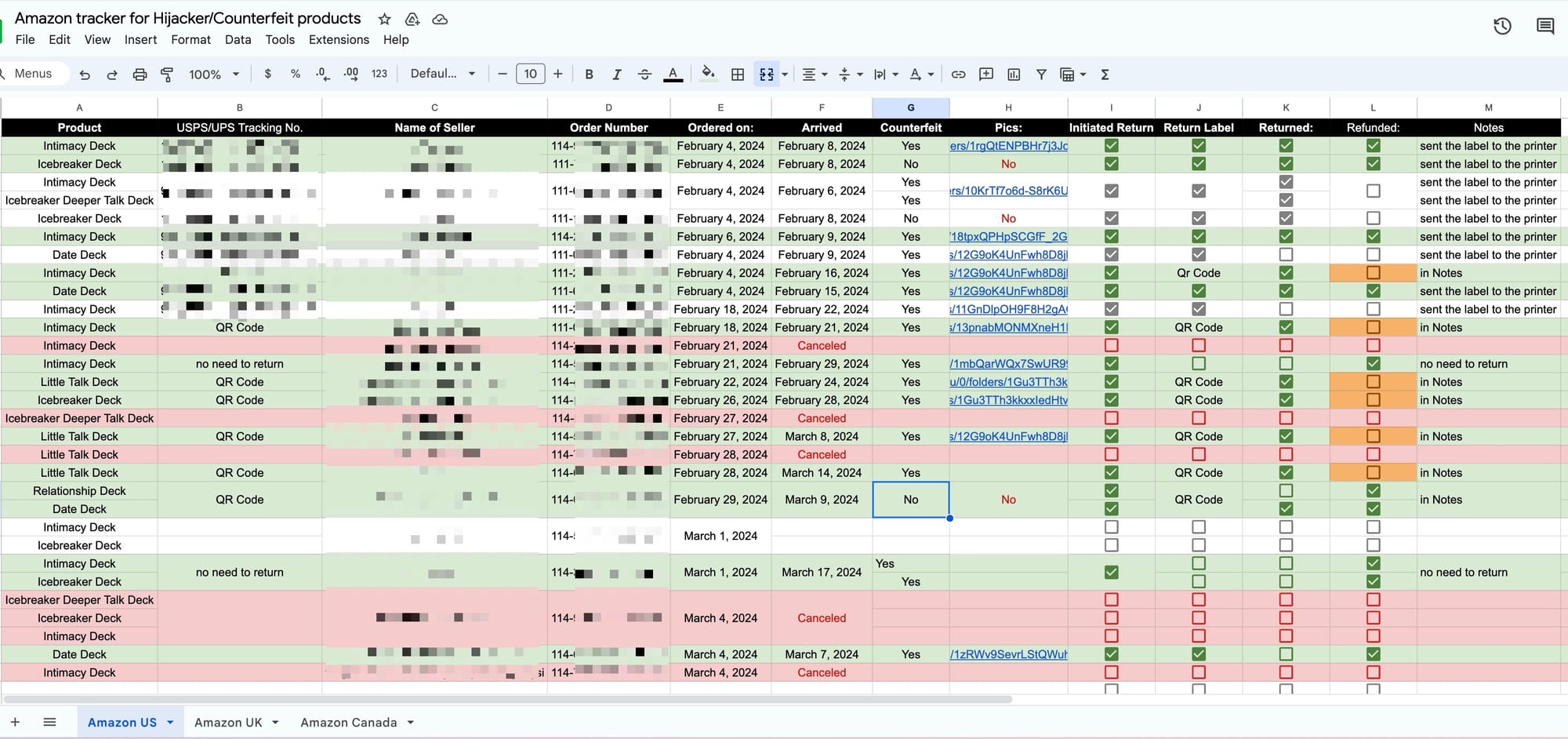

It was hijacked by other sellers selling counterfeit versions of our popular decks like Intimacy Deck. In six months, they only filed two complaints.

This lack of action is egregious considering the people they had on payroll should have been on top of this.

I created a system to get on top of it by having my assistant order from every seller on the listing. I'd get the fastest delivery, document it with photos, and check if it was fake (99% were).

We'd create folders for the fake sellers and make reports.

In the first 4 weeks, we filed over 50 complaints with this manual process. I'd return every fake unit so the sellers didn't get a dime out of me 😆 /petty.exe

After a few weeks of consistent effort, we gained access to Project Zero, enabling us to remove fake sellers from the listing automatically.

Result: 67% Featured offer at closing → 99% Featured offer now. We signed up for the Transparency program to have unique labels on future products, preventing the sale of counterfeits on our ASIN through Amazon.

AI for mass IP Enforcement

I brought on an AI tool to automatically do IP enforcement on our behalf across all global marketplaces. While it's almost impossible to get rid of counterfeiters altogether, making it difficult for them to profit off your brand will likely push them to easier targets.

International Trademark Hijackers

I learned about a scam going on in international markets, particularly in the UK when a distributor of ours reached out after having an IP complaint filed against him.

It works like this:

👋🏻 Attn: North-American based DTC people.

— Cathryn (@cathrynlavery) February 18, 2024

Learned of this UK based scam (could cost you $$$):

1. Scammer sets up a limited company in the UK

2. Scammer then finds US based brands not registered in the UK for the brand / product trademarks.

3. Scammers register that US-based…

Discovered this about 10 days after closing 🫠

Luckily, I caught it in time to protest the publication and got our IP attorney on it. We had a BESTSELF trademark in the UK from when we launched the Self Journal, but not in the card game category because we initially only sold journals.

TLDR; what went wrong:

They moved to a less profitable channel, paid people with the wrong incentives, and lacked transparency within the team.

Fundamental issues fell through the cracks. They also hired agencies that either didn't seem to know what they were doing or were being directed to chase the wrong numbers.

But how can do better than the PE firm?

Complete understanding of the business

One advantage I had over the private equity firm was my intimate knowledge of how all the pieces of the business worked together. I knew our product catalogue, our customers, their problems, our manufacturers, and how we made everything.

I could come up with an idea in the morning, create the product files, and launch it. While I had a team when I sold it, I knew how everything worked together.

No one will care more about the business than you

The truth is, no one will care more about your business more than you will as the founder. Especially when you're bootstrapped and have skin in the game. The buck stops with you and no-one is coming to save you.

With private equity, the people working on the business often don't have their own money involved and therefore have no skin in the game.

Don't overestimate how many team members you need

When it came to getting it back they asked if I had a team to handle the transition. Nope, just me. While I knew it would be a lot of work, I figured I could keep the lights on while I built out a team moving forward.

I wasn't looking to build out the same team I had before. I wanted to stay lean so there wasn't the same pressures I'd created last time with monthly payroll and people management.

Next steps

Besides fixing all the problems I saw above, here's the moves I've been making and the steps I've been taking over the last few months:

Updated pricing (no more 🔥 sale)

When I got the brand back one of the first things I did was change the pricing back to normal. In December when they had decided to sell, they had moved to selling everything on the site to fire sale pricing.

I did the math and calculated that for every order they shipped they actually lost money. I fail to understand the logic of why they did this besides trying to just get rid of inventory.

Cut the bleeding

Having to update payment information on all software, apps and services is great as you realize which one's you really need and which one's you should cancel.

First thing I did was remove all the expensive and unused apps/software. I saved at least $600 of monthly fees from Shopify alone (~$7.2k a year).

Then I looked at the biggest expenses overall to see what else could be either cut or negotiated. I realized the company we used for storage, shipping and fulfillment had changed their pricing model and were charging extortionate fee's for long-term storage.

We had a bunch of old inventory that was accruing fee's, a monthly cost big enough to cover a 2-bedroom apartment in NYC 😱. I connected with a friend who had a warehouse 45-mins from Austin that I could move everything to for a more reasonable cost.

Moved everything out of their long-term storage, or sold it wholesale. (~$48k a year)

Justify every expense

Every $ you spend for your company should either:

1. get you more customers

2. create more value for current customers

If it doesn't do either, do you really need it? Just because you can write something off as a business expense doesn't mean you should. Read that again.

Starting the company with a business partner who was lavish in his "business" spending created bad habits in my last business that were difficult to extinguish. This time I'm working on efficiency and efficacy with every $ I spend from the beginning.

Here's how I think about it now:

Is the expense worth 3x-6x it's annual cost to the business? Because that's the EBITDA it'll cost you to a buyer if you ever decide to sell.

My goal with BestSelf Co is to build a capital efficient business that creates meaningful, high-quality products focused on improving people's lives. This time I'm building it with the systems and operations that would make it sellable, without the focus being on selling it.

Lean team

It's rare to have an opportunity to run an established brand with as little overhead as possible. We'd definitely had some fat to cut when I sold the business. Did we need an 70k+ customer service person? Likely not. But my goal was not to put profits over people. And I likely lacked the courage to make those harder decisions.

The PE firm had let me know they were laying everyone off after their 6-month retention bonus (which is the only reason the team had stayed) which meant there was no team overhead coming back.

I helped several of of my old team get jobs at other companies at the six month mark so I feel good that they found a new spot. There's 3 of my old team at one of my friend's ecommerce companies.

Now that I'm back I'm focused on stabilizing and slow growth. No longer will I chase revenue numbers for the sake of scale and growth if it means doing so unprofitably.

Nor will there be pressure to rush product development in order to drive revenue to support a bigger team than we need.

Last words...

If you sold your company tomorrow, what are the first 3 things a new owner would do?

Many of us know what we need to implement in our business but we're tired, lazy, or both. There was things the PE firm did that were good for us.

They shut down our UK 3PL which was something we had been going back and forth with but hadn't pulled the trigger on. Why? Sunk cost fallacy. We had inventory there we'd need to destroy or give away, meanwhile we were racking up storage fees instead of dealing with it.

They created more systems and spreadsheets for the business so things felt more connected. It's almost like I'd hired consultants to come in and work, now we have spreadsheets for everything. Our google drive was never more organized... 😅

As I move forward with BestSelf, my focus is on creating a sustainable and resilient business. My goal is to stabilize and promote slow, steady growth without sacrificing profitability for scale. This time, I’m committed to building a company with solid foundations, efficient operations, and a lean, dedicated team.

The lessons learned from the private equity experience have been invaluable. They have reinforced the importance of staying true to the company’s core values, maintaining direct oversight, and making thoughtful, strategic decisions.

Stay tuned. The best is yet to come 🚀

Become a subscriber receive the latest updates in your inbox.