Choosing a business partner could be the second most important relationship you ever choose, (the first being who you marry).

If you don’t handle it right, ending a business partnership can be more challenging and more expensive than a divorce.

Having done both, trust me I know.

Now after 5 years of business partnership and 2 months post business “divorce”

— I want to share a little of my story and many of the things I wish I had known to discuss from the beginning.

The truth was I didn’t know what I didn’t know. Now I realize that if we had some hard conversations earlier, we may have had a smoother time ending the partnership.

This essay is a beast, so here's a contents link of everything I'll cover:

- how things went for me; the ‘A’ years

- how to decide if you need a partner

- qualities you should look for (and what to avoid)

- how do you split equity

- the operating agreement; some key things you’ll want in there

- buy/sell agreement

My story

I started BestSelf, with my business partner (who I will refer to as ‘A’) in mid-2015, around 18-months after we initially met.

In that time we’d hung out in person around 4-5 times. To continue the analogy of business partnership being like marriage, I’d married someone that I’d only been on a few dates with and barely knew. I partnered out of insecurity with someone who talked a good game and seemed strong in the areas I felt weak. This insecurity cost me $$$

We met through an entrepreneurship course online and became accountability partners soon after. With him being in New Jersey and me in NYC, we were close enough to be able to meet in person once every few months.

Through being accountability partners we became aware of each other’s strengths and complementary skill sets, him with marketing and me with product design and branding.

As background, before BestSelf was born I had another Shopify store selling graphic design products that was paying all my bills and generating a good living. I considered that business my ‘Freedom vehicle’ as it allowed me to quit my Architecture job but I wasn’t passionate about doing it long-term.

I was deeply passionate about personal development during this time and was always reading and finding ways to upgrade my skills and productivity. I felt like I’d found the cheat code to life and wished I’d been introduced to it sooner. Before I quit my architecture job, I set myself a task to read 22 books around specific topics so I would be ready for the world of entrepreneurship.

The Self Journal was later born from my personal struggle for years of finding a planner that would both keep me organized and also help me reach my most important goals.

I decided I wanted to turn the journal I built for myself into a product to sell, because it seemed whenever I showed it to someone they wanted to buy it. I didn’t think this product would be the start of something bigger, I just wanted to bring this product to life.

It was then I thought having someone who knew sales and marketing would be beneficial so I asked ‘A’ to partner with me on it. He also had his own journaling structure so I felt it was a common interest.

In retrospect, I partnered out of my insecurities around marketing and selling myself.

Most entrepreneurs don’t have business problems, they have emotional problems disguised as business problems — and so I disguised my fear of putting myself out there with a business partner.

And so it began.

The original name we came up with for the company was “Self Improvement Labs”… but I hated it. One weekend when ‘A’ was gone I knew I had to come up with something better to replace it with.

(because I don’t like when people criticize something without giving a reasonable alternative).

In those 2 days I came up with the idea for BestSelf, bought the domain BestSelf.co and created a whole branding package. Thankfully there was no pushback, ‘A’ agreed it was a better name and we moved forward.

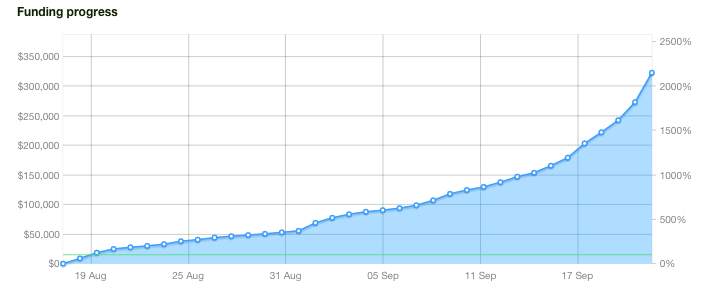

We launched the Kickstarter campaign in August 2015. I had experience with launching Kickstarter campaigns in the past and so I had a formula for how to do it which helped us a lot. You can read how we did it here.

We funded in 28 hours and over the course of 34 days we raised over $322,000 which was enough to both create the product for backers and launch the entire business.

We launched our online store in January 2016 and the business continued to grow. We won the 2016 Shopify Build a Business award in August of 2016 and then in 2017 we scaled 4X and won the Build a BIGGER Business Award.

When things are going so well business-wise it’s easy for things to run smoothly, it’s like the early dating phase when you don’t have to deal with too much harsh reality yet. Then the pandemic starts and you find out what your relationship is really made of.

By late 2016, while professionally things were still good with the business, cracks began appearing in our personal relationship… the 2016 election was a definite factor here. That was the first time it became clear how differently we saw the world and how opposite our backgrounds were.

In 2017, we’d hired out the majority of his role in marketing and by April 2018 he had stepped away from all business operations – informally anyway.

By informally I mean there was never a discussion of him passing the baton and stepping out, he just suddenly was no longer there. But he was still taking as much money out of the company as I was — or more.

As you can imagine being a 50/50 partner where one partner is working full-time and the other is completely disconnected is tough — really tough. I was essentially hamstrung on big decisions and company direction.

And anything I could decide could be overwritten or debated even after I thought it was settled. The same went for team members, as every now and again he’d jump on calls, start giving advice or instruction (without knowing what was even happening) and cause frustration and confusion with team members.

By early 2019, I was becoming resentful as our distributions were still 50/50 but I wasn’t getting any salary for the 60+ hour weeks of time I was putting in. When I brought it up to him, as if he were my boss, he would say “I don’t equate time with value,” yet he wasn’t giving either to the company.

At the same time as he would reject my salary request, he’d post stuff like this on his Instagram:

Here’s a tip, if someone’s telling you running a business is easy — they’re either lying, or trying to sell you something.

In the case of ‘A’, it was both.

Each video “guru” post he’d share taking credit for work that wasn’t his felt like a slap in the face — not just to me but, more importantly, to the team. Being under-paid (or not paid at all) is one thing, but having my value be dismissed on top of that was actually the bigger issue — and was the beginning of the end.

I ended up removing him on all social media platforms in mid 2019 because posts like the one above were triggering me.

By July 2019, we finally agreed on a modest salary for me in lieu of taking distributions which I would be made up for later. This still meant that I was getting the same $ amount or less per month as he was but at least now I had an IOU.

(I did this as I didn’t want to take more cash out of the business that would negatively impact our growth.)

Yay, a salary! I was now the 3rd highest paid person on my team of 10 — and getting the same as the person that had done nothing for the company in more than a year.

By the end of 2019, other things happened that I won’t go into. Suffice to say, I was mentally exhausted and felt completely taken advantage of by someone I had trusted.

So we looked for options to get out…either of the business, or at least the partnership.

When numbers around buyout expectations came up, there was a chasm of difference between what ‘A’ felt he deserved and what was realistic — especially given how much he’d already taken over the last 18 months without working ($400k+).

Taking on investors or another partner seemed like the only option. However, by that point, I had no interest in bringing in someone that may have me ending up in the same place.

Better the devil you know…

Going into 2020 I felt stuck between a rock and a hard place.

On one hand I wanted to grow the business, innovate with new products and keep my team charged. Yet, on the other hand, I knew doing so would mean eventually paying him more in a buyout situation.

Every year I do a yearly review to reflect on the prior year and to set some big goals for the new year. Maybe you’ve seen them. Good, bad and mixed… I’ve shared my review publicly in 2014, 2015, 2016, 2017, 2018… right up until this year.

This year I couldn’t bring myself to share my review and big goal publicly.

(It seems funny now given the dumpster fire that 2020 has been that I just knew putting plans out there might not be the best idea.)

The thing I was scared to share publicly was that my biggest goal for 2020 was to end my business partnership with ‘A’ once and for all.

Between COVID affecting business and other extenuating factors, we could finally agree on a reasonable buyout number in August 2020 — after over 7 months of negotiation. While it had me taking on a significant amount of personal debt, I was happy to do so because I believe so strongly BestSelf — and in my incredible team.

As of September 24th 2020 I’m officially 100% owner in BestSelf – official announcement here.

To say I was excited would be an understatement 🙌🏻

What I would do differently

I don’t believe in regrets or wishing things were different – everything worked out as it was meant to and this was a huge learning experience for me.

“Don’t wish it was easier, wish you were better” – Jim Rohn

This famous Jim Rohn quote perfectly fits here, this whole experience taught me a lot about myself and what I’m capable of.

That said… I learned some big lessons that would make me approach any future partnership extremely differently. And I want to share them in case they help you avoid some of my mistakes. .

In an alternate world, if I could tell myself what to do differently, this is how I would approach it:

How to decide if you need a partner

First thing is to get really clear on whether you need a partner or not.

Many of the world’s biggest companies have multiple founders, AirBnB, Uber, Google, Apple etc.

However recent research by NYU and the Wharton School shows that entrepreneurs who start a business on their own are likelier to succeed than those who do so with one or more partners

Many of us look for a partner out of insecurity (me), because building a business can be hard and lonely by yourself. It’s also harder to afford people at the start when you’re just starting something so you consider partnership as a cheaper version of getting a worker.

Also equity is cheap – at the start.

But it gets expensive hella fast and can cost you $$$ later.

Let’s not throw money away and make expensive mistakes you’ll regret later. Instead let’s do a little work up front to make sure you’re fully considering this.

Questions you need to ask:

- What are my goals for this business?

- What are my financial resources?

- What are my strengths and weaknesses?

- What parts of starting/building this business am I the most unsure about?

- What resources are needed for this business — what am I missing?

- What skills or experience do I need for this business to succeed?

- What pieces are missing that will help me succeed?

- What might my perfect partner look like? What would their role be?

If you answer these questions and the only missing piece is money – get a loan or find investors.

If you need a developer, designer or some hired help, hire them but don’t make them your business partner if that’s all you need. If you have no money, you can give them a little equity without making them a co-founder.

Still think you need someone and have someone specific in mind, answer these:

- What are his/her strengths and weaknesses?

- What are his/her goals?

- Do we share the same core values?

- What is his/her work ethic?

- Will their skills complement or duplicate mine?

What qualities you should look for:

1. Financially stable & sensible

If you’re going to be partnering with someone, you’re placing a lot of trust in them and possibly your entire professional future (no pressure 😅).

If someone is financially responsible and stable in their personal lives they are much more likely to be the same with business. On the other hand, if they are irresponsible that only multiplies in a business setting — but now you could be on the hook with them for their bad decisions.

When setting up a new business there’s costs upfront, and due to your business and tax number having no credit history you pretty much have to use your own social security number and have a personal guarantee on everything.

When starting BestSelf, I signed up for all the company cards using my social security number rather than ‘A’ because he said his credit wasn’t very good.

That should have been a red flag at the time.

No, not because having bad credit makes you a bad person — but because I should have been the one with way worse credit!

Why? As the immigrant who had just moved to the US less than 4 years before, I only got my social security number in 2011! This meant I had very little credit history by 2015.

No joke it took me over 2 years to be able to qualify for store credit at the Gap. That was a glorious day indeed

The fact that my credit was better than his should have been a red flag.

Hindsight is 2020

I also just trusted him, which turned out to be a mistake. Since then, I would also never go into business with anyone without doing more due diligence, including a comprehensive background check.

Solution: Trust but verify. Get a background check and credit score of any potential business partners as well as a SafetyPIN trust badge.

2. Shared Vision & Goals

Do you and your potential partner share the same vision for the future and where you want to take the business?

For example, if you want to start a lifestyle business that you bootstrap, grow slowly and work on the rest of your life and your partner is looking for explosive growth and a big exit in 2 years… well that’s gonna be a shitshow. Those two visions are polar opposites and will not end up well.

This was the case for myself and my business partner. It went from us saying we would never sell, to him being all about explosive growth (whether profitable or not) and a big exit.

Solution: Be honest and open with your vision and goals for the business. A big exit might sound awesome, but if it doesn’t happen are you both going to want to be working on this for years to come?

3. Emotional Intelligence

Emotional intelligence is the way we navigate both our own feelings and others feelings. In a study of 515 senior executives it was found that emotional intelligence was a better predictor of success than either relevant previous experience or high IQ.

When deciding a business partner you want to find someone with a high EQ score which will help with collaboration, managing stress and avoiding conflict.

4. High Integrity

Integrity means showing a consistent and unwavering adherence to ethical principles and values. You need to be able to trust this person fully to do right by you and others as you/your company will be judged by what they do.

Before bringing on a partner, get references from others who have known this person a long time or have worked with them so you can get more background on how they behaved in the long-term.

Much like you often need a reference for a new job or apartment, you should get multiple for those you intend to go into business with. You should also be willing to provide the same to them as there are risks on both sides.

Solution: Reference check any potential partner with people who have known them for multiple years in different capacities — as a boss, partner, employee, etc. You should also keep an eye out for any unethical behavior – even if it’s towards someone else or seems small because if they’ll do it to someone else then they’ll do it to you.

5. Similar work ethic

When considering a business partner, try to align your work ethic or set expectations up front so that there’s no resentment later. There should be a clear division of roles and expected contributions. This is important especially at the beginning when a new business is like a new baby, it needs constant attention, and can be exhausting — but it needs to be there to get that initial momentum.

In the beginning of the business in 2015 ‘A’ and I shared the same work ethic and were grinding hard to get the business off the ground. However as we scaled, our roles/responsibilities evolved (or devolved) and we didn’t have any terms or structure around how to manage that change.

When we started out we each had our roles and responsibilities, me with product/brand and him with marketing. However, it was relatively easy to replace his marketing role but finding someone to develop new products and take on that role was difficult as I still needed to drive initial ideation.

In the operating agreement section below we’ll get into how this could be laid out so that you wouldn’t end up carrying the weight later on when roles evolved.

How do you split the equity?

Now you’ve decided you need a business partner and they have all of the above qualities… Now you need to decide on an equity split.

Do not do a 50/50 partnership. I beg you.

While yes it is a fairly common way to decide equity splits because a down-the-middle split seems ‘fair’. However, it’s also lazy and more often than not is a bad deal for one person, and gets worse the longer it goes on.

Your business isn’t pie, and ‘fair’ doesn’t mean equal.

50/50 isn’t a business decision, it’s a settlement.

And when you have to make big decisions — or want to sell or dissolve the business, it’s a shit show.

You need a decider. Even if you end up close at 50.5 and 49.5, that will make life so much easier for both of you.

But let’s take a step back and discuss the best way to figure out the right split. You each bring different skills and value to the table and that’s very rarely exactly equal.

Some of these are:

- Sweat equity

- Money

- Skills

- Network

- Original idea

- Experience

I don’t have an exact answer on how to split equity – it seems like an art rather than a science. However I did a bunch of research on how it could be done by reviewing different skillsets, This is the formula that Dan Shapiro uses or check out Slicing Pie, a software created for just this reason.

Back in 2015 I partnered out of insecurity and discounted what I brought to the table when I partnered up with ‘A’.

Previously I’d had a Shopify store making over 300k a year, I’d successfully funded 3 Kickstarter campaigns, I had a background in product design. I’d spent years building my personal network of people in the industry that were the ones who really helped us with our launch. I created the written content for marketing and building out our list, and I put up the initial capital for preparing for our Kickstarter campaign.

‘A’ helped with marketing, setting up our email list, Facebook ads and any Leadpages we needed and promoting any content I wrote to build our list. In fact at the beginning he didn’t want to do a Kickstarter campaign, he thought it was too much work… I had to talk him into it.

There was a big difference between what I was bringing to the table and what he was.

However at the time I was naive, insecure, and not confident enough in my skills to have a tough conversation around equity.

✅ an expensive AF lesson learned

Pot committed; why vesting is crucial

Vesting is a term I wasn’t even aware of back in 2015, but it’s essentially a way to accrue your equity over time instead of getting it all at once. This is a great way to ensure both parties are committed long term.

It’s very common to have a vesting schedule for the founders in startup & venture capital world, yet not nearly so much with small business or bootstrapped companies.

It’s common with employees to have a vesting schedule as you’d want to incentivize them to stay long-term rather than potentially getting shares up front and then leaving with little bits of your company.

In the startup world the vesting schedule is generally a 4-year term in which time your equity would vest. It’s common that there’s a 1-year cliff attached which means that this time period must pass before any of the equity or stock vests at all.

For example with a monthly vesting period over 4 years you would get 1/48th of the stock each month, with a 1 year cliff you would get 25% on day 366 of being with the company and the rest will vest monthly over the remaining 3 years. If the company is acquired in that time, it’s common to have your stock fully vested upon a liquidation event.

My mistake: We both got our full 50% equity up front.

This became problematic for me when just over 2 years later ‘A’ decided to step away from the business which meant 50% of the equity walked out the door.

Had we still done the 50/50 split but had a vesting schedule, he may only have been able to walk out with 20-25% equity.

Vesting alone would have saved me hundreds of thousands of dollars and a lot of time / energy.

Operating agreement

(read: boring but important AF paperwork)

You must have an operating agreement for your business. The purpose of this is to govern the internal operations of the business in a way that suits the owners.

If you are taking on a partner, it is even more important to work with a lawyer to create this. Do not use a template or try to save money by avoiding using a lawyer.

Remember what I said, there’s nothing as expensive as an inexpensive / inexperienced lawyer. This is one of the ways I screwed myself and let my personal animosity toward paperwork become a huge problem later.

Lazy / Complacent = Super expensive to fix later

In fact, have an attorney for the business AND you should each have a personal attorney. It sounds odd but you need someone to represent YOUR interests against your own business to make sure you are protected.

A solid operating agreement should cover:

- Ownership & equity percentages

- Capital Contributions

- Management structure / Roles & Responsibilities

- Voting / How decisions are made

- Allocation of Profits, Losses and Distributions

- How the taxes on this distribution are allocated and distributed

- What happens if there’s a disagreement on the direction or future of the business?

- What happens if an owner wants out or passes away?

- Process for admitting new members

- How new members make initial capital contributions and the required amount per member

- If (and when) additional contributions are required and how members decide

- Trigger events; bankruptcy, divorce etc.

After your corporate attorney drafts your agreement, each member should have their own lawyer review it so you are properly informed and looking out for your best interest.

This was an important step that I missed.

If I was to describe our operating agreement, I believe the technical term for it would be… piss-poor. There were so many issues with it – literally every lawyer I showed it to told me how bad it was… it was almost worse than not having one at all.

There were no provisions in there for what would happen if members couldn’t agree, nor was there anything in there about a buyout, which was what we needed. As far as disagreements went, there was no mediation clause or next steps, if we couldn’t agree it merely stated we could dissolve the company altogether.

ACTION: Write a list of all the possible worst-case scenarios you could come across and make sure that your operations agreement would answer each of them. This is your business prenup!

Once you’re done with that list, start googling around to get some insight on other possibilities of things to go wrong, and make sure you’re covered!

Most of the issues and challenges I faced were due to not having a strong operating agreement. Hence, I’m restating the point that you need to be on top of this.

In an ideal world, your operating agreement is an IF THIS, THEN THAT equation that would cover all scenarios, likely and unlikely.

As far as a buyout goes there are a few clauses you could consider:

Shotgun clause; this is a fairly popular one that can be used to force a partner to either sell their equity or buy out the offering partner. If you name a price, they get to choose whether they get to buy or sell at that price so it entices you to offer fair market value for it.

Third-party valuation: agree on how you’re going to value the business ahead of time in your operating agreement. Do some research on some common formulas or multiples for your specific type of business. A common formula for this type of business is 2X – 5X EBITA (Earnings before Interest, Taxes & Amortization)

Different businesses are valued differently, for example, a software company will get a much higher multiple than an ecommerce company.

Buy-Sell Agreement

In marriage, the general statistic is that 50% of marriages end in divorce.

Well, 100% of businesses are going to end at one point or another and should be planned for at the beginning. Think of the buy-sell agreement as the prenup for your business.

It lays out what should happen should someone either die or choose to leave the business.

A buy/sell agreement will determine how you value the business. It will cover things such as:

- What should the business be valued at?

- How quickly am I going to get paid out?

- Who can I/can I not sell to?

- Does my spouse have to sell back to the business if I die?

- What happens in a divorce when assets are split?

One thing we did have covered was Key Person Insurance, which is a life insurance policy that the company purchased on each owner’s life, mine, and ‘A’. The company is the beneficiary of the plan and pays the insurance policy premiums. This meant if either ‘A’ or myself died, the company could afford to buy back the equity from the estate of either of us and hire someone to replace that role in the company.

[If this was a true crime podcast, that would be a motive right there ]

Another issue I had not foreseen was divorce, specifically a messy contentious divorce.

I got divorced in 2017, it was uncontested, my ex and I remained on reasonably good terms throughout and got everything done without the need for expensive lawyers. However, this wasn’t the case for my ex-business partner ‘A’.

In September 2019, ‘A’ and his wife separated and began divorce proceedings. For reasons I won’t share here, it was a contentious divorce from the beginning and only went downhill from there.

This meant all of his assets were frozen and could not be transferred or sold without the permission and approval of the soon-to-be ex-wife. (!!!)

Given that BestSelf was a significant part of his assets, it made the buyout that much more difficult and drawn out. It took us over 6 months to finally agree to a number and terms, and then another almost 2 months to get approval from his wife on it.

Meanwhile, during this process, the company (and I) are racking up legal bills dealing with the added complexity of his divorce. Unlike mine which was a relatively straightforward transaction and cost the company $0, his involved dealing with multiple lawyers all of whom had different agendas (divorce, business, personal, etc.)

I think there were 5-6 different lawyers involved between all parties.

Needless to say if I never pay another lawyer again it’ll be too damn soon.

Solution: In the operating agreement there should be a ‘Trigger’ event in case of a death or divorce . This would force the spouse to sell their equity back to the business or for them to buy back any equity that would result from a divorce. Essentially you want to be sure that the company will not be going into business with an ex-spouse or widow if the occasion arose.

General rules

Here’s some general items I would also think to include given my own personal experience:

1. Fiduciary responsibilities to the company

Transparency on projects outside the company should be shared and there should be no ownership that would create a conflict of interest.

There should be rules between what can be shared outside the company as far as internal company knowledge and stats. Can owners share internal documentation, process or numbers for their own personal gain?

That needs to be laid out so that you don’t end up scrolling through social media and seeing a partner sharing some secret sauce. This is one of the cases in which ‘A’ used company data to try to sell information products without my permission.

2. Employment agreement & IP signed off to company

Each owner should sign over IP created by themselves to the company. This means any content, product etc you create will be owned by the company not by you as an individual.

We didn’t do this, however in 2019 I was able to use this as leverage during my salary negotiation (or y’know just trying to get paid any salary) because at that time technically many of the top products were still owned by me, the individual who had come up with them due to copyright law. Once I was given a salary I signed the IP over to the company.

3. Explicit company expense policy

At the beginning of the company, money was scarce and so we were very careful about how we spent it. In fact for a few months in the beginning we shared one gmail address with different aliases to avoid paying that extra $5 per month.

However as we grew, expense bloat also happened. ‘A’ and I looked and treated money very differently which began to cause issues. Financial stress is one of the biggest reasons for divorce, and it’s no different in a business partnership.

One example was when he would book a first class seat while I was flying economy. I didn’t think that was a good use of company funds, and we had to come up with a rule where airline points could be used for upgrades but not cash — unless the flight was over 6 hours. If you wanted to fly first class you would pay for the difference back to the company personally.

Long after ‘A’ worked in the business day-to-day he’d still use his company card for paying flights, food, random consulting services, health insurance and even babysitting on occasion…

As you can imagine, I was infuriated to be footing the bill of thousands and thousands for his lifestyle and outside projects.

Final thoughts

Like I said at the beginning choosing a business partner could be the second most important relationship you ever choose and it could make or break your business.

In my case it almost broke me and the business.

I lost a year of creativity, positivity and I stopped being transparent because I couldn’t share what was really going on in fear of reprisal — or that it would hinder my escape.

So I smiled and said nothing.

If it weren’t for my incredible team and my support system of my fiancé, friends and mentors that were there for me during this time I may have cracked. Some days I felt like maybe I had cracked.

“And when you become a diamond, you’ll see why life had to pressure you.”

The trauma of being undermined, gaslit, unappreciated and made to feel small are the invisible wounds of this broken partnership that will heal with time.

I finally made it out the other side, with my integrity intact and knowing I learned a lot from the experience.

While I took on a bunch of personal debt to be able to finalize the buyout and should be feeling a whole other type of pressure, I don’t. I feel free and finally in charge of my future and what I can create. It’s only been a few weeks but I already feel brighter, more positive and like a weight I’ve been carrying for years has finally been lifted from my chest.

It’s my personal responsibility as 100% owner of BestSelf to get back to being my highest value self which means product development, innovation and leading the team forward.

Look forward to more articles, videos & strategies as I take BestSelf to the next level, this is only the beginning

Big takeaways & checklist

Rather than rehash the items above, I created a checklist of items & resources for you around business partnership that you can grab here (no email necessary).

Become a subscriber receive the latest updates in your inbox.