One of the biggest life hacks out there for business owners? Credit card points.

Smart entrepreneurs divert funds they’re already spending in order to take advantage of all the tax-free rewards – like free first-class flights, hotel stays, and shopping experiences. I’ve saved TENS of THOUSANDS of dollars on these over the years.

Disclaimer: Much of this advice is targeted towards US business owners. Unfortunately, there are much more generous reward programs here, probably due to more regulation in other countries (like the EU) about how much cards can charge merchants. Less profit for them = less rewards for you.

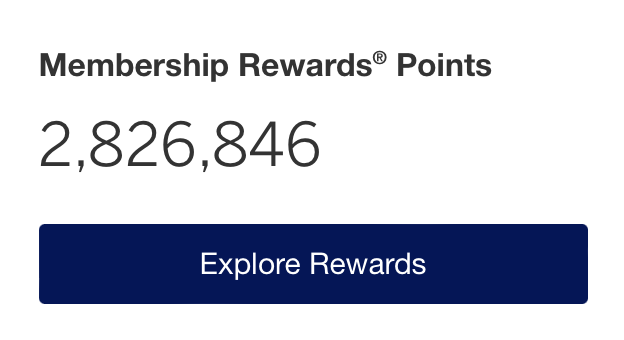

Here’s how you can start racking up points so your AMEX rewards look like this👇

Credit Card Rewards 101

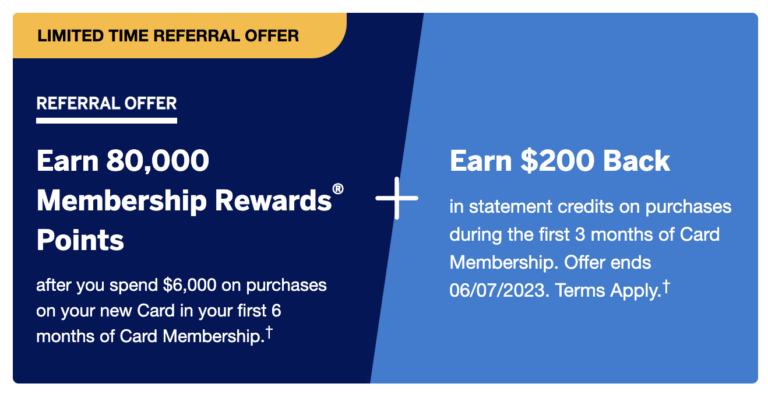

Companies offer credit card rewards to both get people to use their cards more often — and to attract new customers. That’s why new customers often get signup bonuses like this:

(I’ll share a few of my favorite cards in this post that offer 100k points at signup)

So firstly why do credit card companies offer these rewards? Well, the more people use their cards, the more money the credit card company makes from transaction fees and interest charges.

The rewards offered can range from cash back, miles, points, or discounts on purchases. The trick for you is to maximize your rewards by diverting cash you’re already spending on the right cards.

So the more you spend, the more you get rewarded.

An interesting note: These rewards aren’t considered taxable income, which means you can accumulate a huge number of points each year tax-free.

Whether you’re looking to fly first-class, take a vacation, or buy some new West Elm furniture (NOT cheap!), credit card points can help you do all that.

How business owners should use credit cards

For business owners, taking advantage of credit card rewards is a no-brainer. If you do it right you’ll never be paying for any personal travel again. I’ve been using points to travel back and forth to Europe in business class for years — often for less than $50.

Choose a business credit card that offers rewards to match your spending habits

People in e-commerce like me – spend a lot. Google and Facebook paid ads, software spending, the latest and greatest tech, etc.

As an entrepreneur, the key to maximizing your credit card rewards is to use the right credit card for the right type of spending.

For example:

- If you run paid media (FB ads, Google, IG, etc) look for a card that offers points multipliers for advertising spend. I’ll share my favorites for these below.

- Travel a lot for business? Get a card that rewards travel.

It’s not rocket science.

Make sure to take advantage of any bonus categories, sign-up bonuses, or special promotions offered.

My favorite credit cards

Choose your own adventure. For example, need a credit card with travel rewards? Try the Chase Ink.

I’ve found these are the best credit cards for business owners:

1. AMEX Gold Card

Run paid ads?

You can earn 4X points per $1 spent on ads up to $150,000, which means you can accumulate up to 600,000 points each year. LFG 🚀

The AMEX has a lot of other benefits too including lounge access in airports around the world if you’re traveling a ton and want to get some work done while stuck on a layover.

Expert level: If you’re a big spender, you can even get up to 6 cards on the same business – yes, 6! This means you can get 3.6 million points each year. Unreal!

You can get 70,000 bonus points when you sign up. Holy.

2. Chase Ink

Current signup bonus: 100,000 Bonus Points (or $900 if you want the cash card)

Another good option for taking advantage of ad spend – or if you don’t get approved for the AMEX Gold.

Earn 3X points per $1 spent on advertising up to $150,000, which means you can accumulate up to 450,000 points each year.

If you get three cards, you can multiply your rewards even further, for a total of 1.35 million points each year. Again, this is bonkers.

(Getting multiple cards per business can be tricky depending on your rep and how well-versed they are. I was years into e-commerce before I learned about being able to stack cards. Tread lightly.)

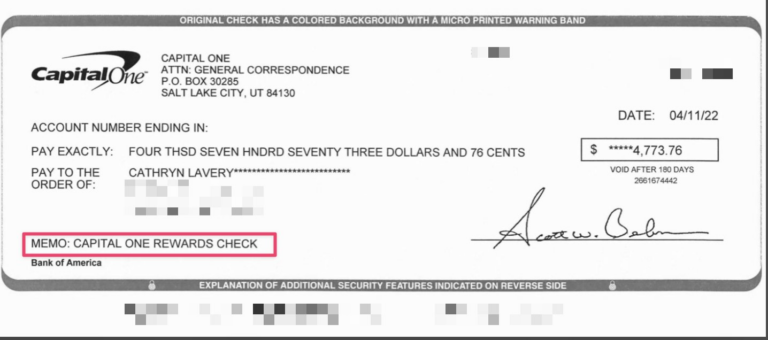

3. Capital One Spark Card — Unlimited 2% cashback

Want cashback rewards?

You can earn 2% cashback on all purchases with the Spark Card, which can be cashed out anytime tax-free. It’s not a 1099 because it’s considered a rebate of sorts. This is the last check I got from them.

Personal cards:

AMEX Platinum

The rewards and benefits of this card are incredible, here’s some of the stuff you can get:

- $240 digital entertainment credit (Audible, Disney, Hulu etc)

- $200 hotel credit

- $200 Uber / Uber eats credit

- $200 Airline fee

- $189 Clear membership (must-have for frequent travellers!)

Although it comes with a $450 annual price tag, I think it’s worth it if you use all the benefits.

Another key thing about this card is that you can exchange your points for cash through Schwab to either invest in the markets or transfer the money to your bank account.

Chase Sapphire

Signup bonus: 60,000 points ($900 toward travel)

I also dove into each of these cards in this thread here:

One of the biggest lifehacks for business owners?

— Cathryn (@cathrynlavery) July 11, 2022

Credit card points. You can stack MILLIONS a year *tax-free* and never pay for first class travel again.

If you're not doing this, you're missing out. Here's why 👇🏻

Actually redeeming your points (the whole point!)

(Again, if you’re a credit card points beginner, stick to one card before starting to stack. That’s a conversation for later. You’ll thank me.)

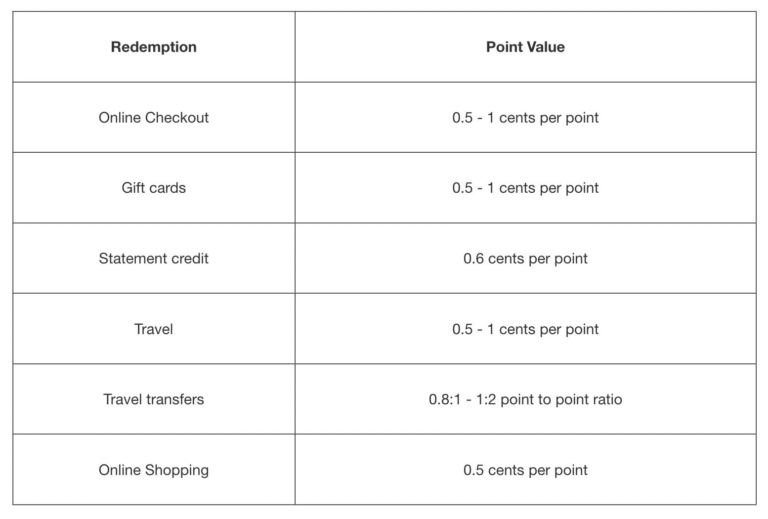

So once you’ve accumulated lots of points, you can redeem them for whatever you want – cash, travel, charity, miles and airline points, etc.

Or keep saving!

A quick hack for flight rewards – Don’t use your card’s travel portal. Instead, transfer out your points to the airline you’re flying and you’ll get a better bang for your buck.

I learned this the hard way. Spent way too much and realized my money goes further.

And cashback peeps, you didn’t think I’d leave you hanging, did you? A quick hack for cashback – If you have the AMEX Platinum, you can exchange your points into cash and invest in the markets (or send them directly to your bank account).

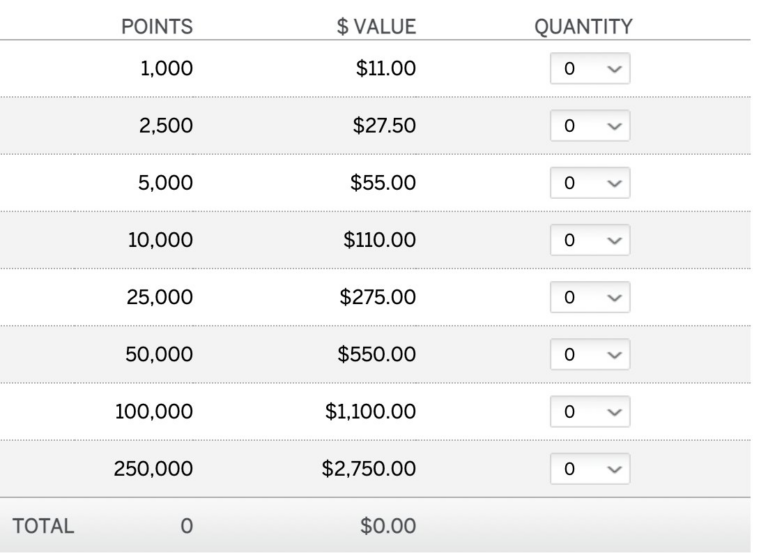

Here’s the exchange rate. This money will be transferred directly to your Schwab investment account… Yeah. From my Amex points balance above, that’s over $31,000 I could transfer into cash — tax-free.

During the pandemic when I wasn’t traveling, I used my abundance of points to buy all new furniture, dress up my nursery for an incoming baby (Quinn is finally here!) and get a new Traeger grill. There are two ways to do this:

- Exchange for gift cards (worst way to do it… also learned this the hard way)

- Buy on a card and redeem points for cashback. You’ll get more points for the purchase but can redeem cashback and send it right back to your bank account to pay off the bill.

Knowing what I do now, I would have gotten more had I exchanged it for cash thru Schwab. Make sure to check redemption rates on gift cards vs cash exchange.

Point stacking for credit card point savants

Once you start to stack credit cards and get a $*!% load of points, it starts to feel like monopoly money because they rack up so fast.

Then you can do fun things like…

- Rewards for your team (retreat, gift cards, etc)

- Experiences for family & friends

- Pay off student loans

- Donations to charity

Also, I’m lucky to know a great friend who is an absolute wizard with credit card points-maxing.

Allen Walton – The real points guy imo. Sometimes he does fun stuff on Twitter like this:

20 minute fun time

— Allen Walton (@allenthird) February 17, 2023

If you have 150k credit card points and wanna go to Europe in business class this year, reply with:

• Your available points

• Home city

• Ideal destination

• Number of seats

• Ideal dates

I'll tell you if anything good is available at this moment

You just have to use the right card for the right type of spending, remember you’re not just spending for the sake of points, and make sure you pay off your cards every month.

Then you’ll be fine.

Credit card point gurus: What’d I miss?

Become a subscriber receive the latest updates in your inbox.