I’ve been getting asked if I’ll still be crypto-ing after the baby. Yes, obviously. Otherwise, I’ll have to tell my baby hfsp… but my time will definitely be more limited.

Since the baby will be keeping me up (instead of degen yield farms) I decided to be responsible and put my crypto to work.

Here’s where you come in… if you’ve been in DeFi but don’t have the bandwidth to monitor opportunities constantly — this portfolio might be for you too. (No baby required!)

Here are my yield parameters for a maternity portfolio:

✅ Low risk & complexity

✅ Lower volatility asset

✅ Very low to zero expected Impermanent Loss

✅ Minimal ETH gas fees

Main coins I am working with:

- $ETH

- $USDC (stablecoin)

- $UST (stablecoin)

- $CVX

- $LUNA

- $AVAX

If you want a complete guide to everything I talk about in this email (and much much more) then consider joining Zero to DeFi, my course in decentralized finance and crypto. Learn more here.

Ethereum:

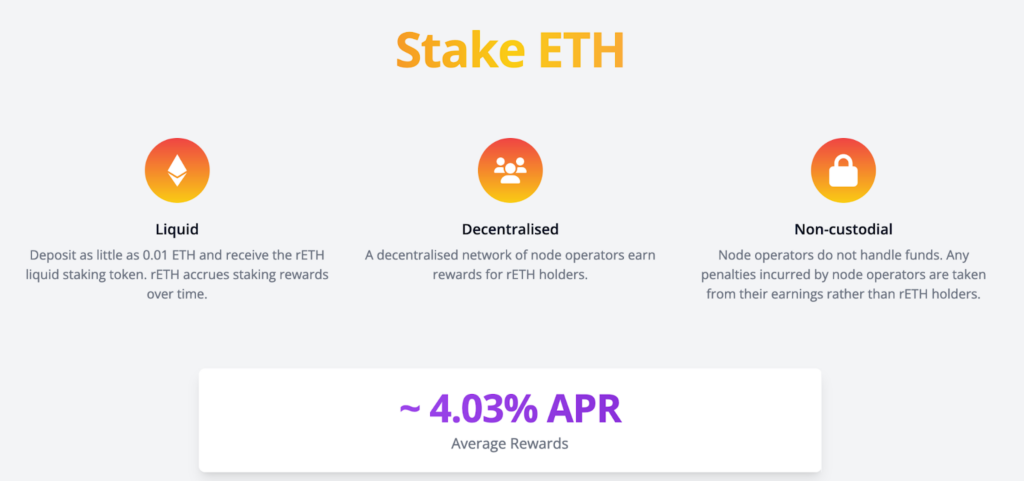

The best passive yet safe yield for Ethereum is staking for rewards. Staking rewards are what you get for helping a system work by staking your coins to help secure the network.

Ethereum is moving from a Proof of Work System to a Proof of stake system this year, which is what you are helping when you stake your ETH. Now staking is all fine and well, but it’s not the best yield to stake alone — we want to be able to have our cake and eat it too. That’s where liquid staking comes in.

Liquid Staking

Liquid staking is the act of delegating your tokens for staking without losing access to your funds. This means you can stake your coins to secure the system, while still maintaining liquidity and being able to use your assets for other opportunities. It’s low risk for high reward.

I have my ETH split into 3 different pools:

- Liquid Staking: A passive set-and-forget-it (70%)

- Yield farming: Finding the best yield, riskier than above bucket (25%)

- New opportunities (5%)

1. Set-it-and-forget-it stack:

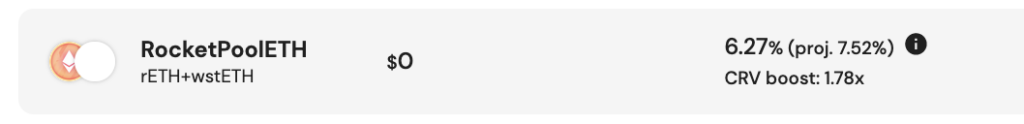

- 70% liquid staked in Rocketpool making 4%

- Took the rETH liquidity tokens and put them into Convex Finance for an additional 7.63% APR

Total yield = 11.63% APR

2. Yield Farming ETH stack:

In general, I move this farm around to find the best yield without taking on too much risk.

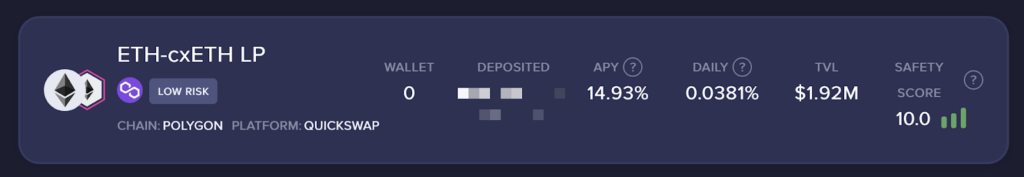

For now, the best spot for this is the ETH-cxETH in Beefy Finance on the Polygon network. By pooling ETH with cxETH (a Celsius wrapped synthetic Ethereum) I should have very low to zero expected impermanent loss.

Since Beefy Finance auto compounds rewards to get approx 15% APY on ETH.

✅ It meets the criteria of low risk, low volatility, minimal fees (only pennies on polygon), and no expected IL.

3. 5% ETH sidelined for random opportunities

Generally, ETH is the best coin on Ethereum to allow low-slippage swaps so I have a small stack to be able to buy opportunities.

Stablecoin options:

I have several different stablecoin farms set up across different protocols/chains. Some are auto-compounding and others require harvesting rewards every few days, this still meets all my maternity criteria as the farms that require harvesting are on Fantom and Avalanche meaning minimal fees.

Stable yield farms I’m in:

- $USDC on Stargate on Fantom

- $USDC on Stargate on Avalanche

- $UST on Anchor Protocol on Avax (auto compounding)

- $MAI-USDC on Beefy Finance (auto compounding)

Note: The reason I don’t put all stables in the same opportunity is to spread risk. You know the saying, don’t put all your stablecoin eggs in one farm, I mean basket

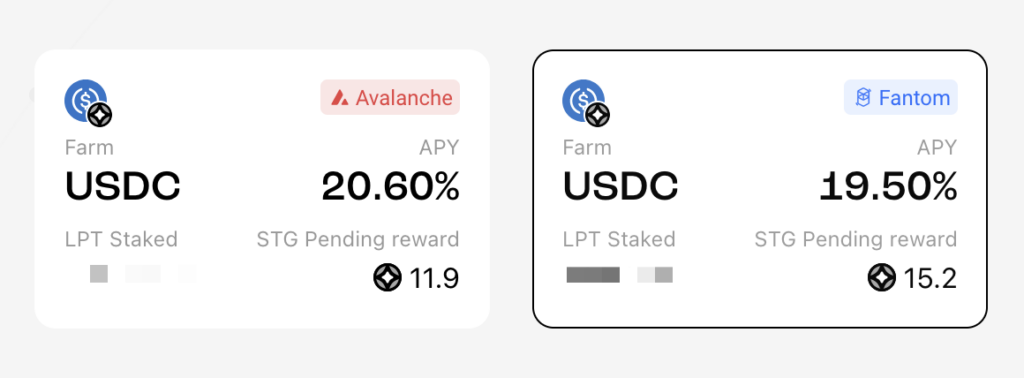

Stargate finance

Farming $USDC on Stargate.Finance on both the Avalanche & Fantom networks for between 18-21% (depending on the price of the token)

There are a ton of stablecoin options across all chains on Stargate right now, I chose Fantom and Avalanche as I had stables sitting there. I also wanted to stay off of Ethereum given the gas fees to claim rewards would significantly impact my ROI. Now if the SGT token drops in price the yield will be lower.

Plan: Harvest and sell rewards into $USDC every 2-3 days.

(this is the most work I’ll be doing on any of these opportunities and will require 3 mins per 2-3 days, very minimal gas.)

Anchor Protocol

Anchor is a decentralized yield protocol allowing users to earn a fixed annual percentage yield of about 20% on deposits in Terra’s native stablecoin, UST. The $UST on Anchor protocol earns a consistent 19-20% APY. I refer to Anchor as my DeFi savings account and have covered it extensively on my YouTube channel.

As of a few weeks ago, it’s available on both the Terra network and the Avalanche network.

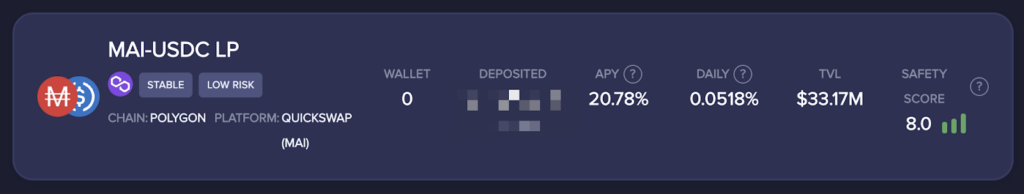

USDC-MAI pool

Mai Finance is an open-source and non-custodial stable protocol, it allows you to keep your crypto and still be able to spend its value by borrowing Mai tokens against it. Mai stablecoin is pegged to the dollar where Mai-USDC is 1:1. To mint 1 Mai token you will need to provide 1 USDC.

For this stablecoin farm, I have put my LP tokens into Beefy Finance which harvests rewards constantly and adds to my liquidity position. As such it currently sits at 20.78% APY.

I’m typically unsure with these algorithmic stablecoins, however, Mai has been very stable over the last year despite market drops. It’s also backed 1:1 for USDC so hopefully won’t have another IRON/TITAN fiasco.

$AVAX:

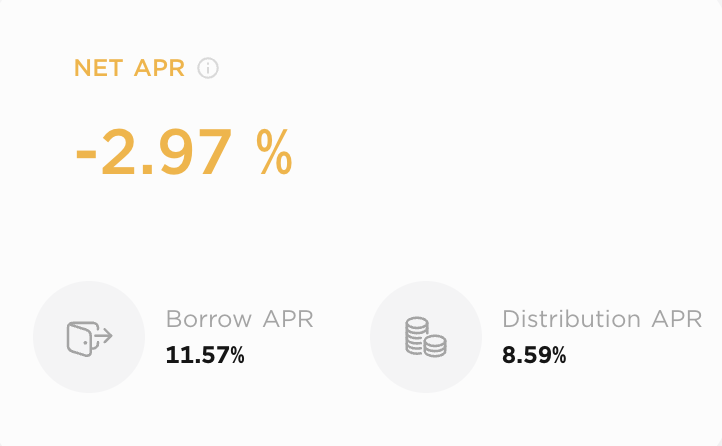

There’s liquid staking available for your $AVAX on Benqui where you can make 7.2% APR and receive sAVAX liquidity token which you can use on Anchor Protocol to borrow against.

If you deposit the sAVAX into Anchor, you can borrow $UST against it (11.57% borrow fee) but you can currently put into Anchor to farm (19.5%) and receive 8.59% in ANC token which would give:

19.5% APR – 11.57% + 8.59% APR = 16.52%

Note: 8.59% of this ‘distribution APR’ would be given in the ANC token which if you wanted $UST you would need to swap out of.

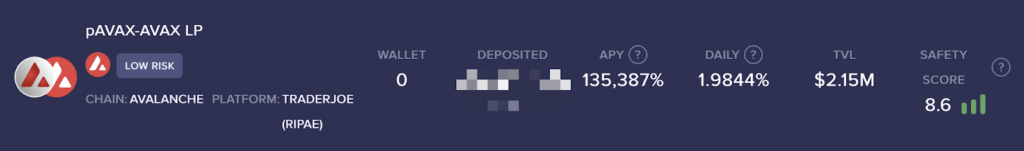

If you want to look for more opportunities on Avax you can check out yieldyak and beefy which can give you more options on pools. Generally the higher the APR, the higher the risk you’re taking.

For example, I have a small bag in this pool (because even my maternity portfolio needs some degen action):

Convex Finance

I’ve covered Convex Finance extensively — if you want to know more about what it is and how it works check out this article and my YouTube playlist.

Previously I’ve been locking and voting every week for bribes, choosing the pools with the most rewards per vlCVX. This worked great up until round 13 when I forgot to submit and ended up with a lot of wallet dust rather than 1 or 2 coins I wanted to hold. Womp womp.

I can imagine once the baby arrives I’ll forget more future votes so to mitigate this I joined Llama Airforce Union to be able to auto-compound my rewards. By joining The Union they will take care of my bribe rewards and consolidate them into auto compounded cvxCRV.

Pro: I can set it and forget it.

Con: Lose some upside from doing it myself & adding an additional layer of smart contract risk

If you want to know how to join the Union or want more detail I have a video here. This meets the criteria of minimizing ETH gas fees, and complexity while maximizing yield.

$LUNA

There are many different options for a yield of your $LUNA, from easy things like staking your $LUNA on Lido for a 7% staking fee to creating a liquidity pool on osmosis.zone of UST/LUNA which currently yields around 44% APR on Osmosis.

There is a chance you’ll get IL here if the $LUNA price fluctuates but pooling it with a stablecoin ($UST) means much less volatility than if it were paired with another volatile coin. It doesn’t autocompound rewards so you’d want to go in every day or so and manually compound to maximize rewards. Transactions on Osmosis are super cheap and fast!

If you want to get started on Cosmos & Osmosis I have a video on doing that here.

More opportunities

If you want to find more opportunities for yield you can check out these sites:

- Beefy.Finance

- Yearn.Finance

- Convex Finance

- Yield Yak (avax auto-compounder)

- Stargate Finance (multi-chain stables)

Now if you got to this point of the article and you want a complete guide to everything I talk about in this email (and much much more) then consider joining Zero to DeFi, my course in decentralized finance and crypto. Learn more here.

Not only will you learn about how to do all this, but you’ll be the first to know where I’m moving yield to when rewards change.

Become a subscriber receive the latest updates in your inbox.