Credit card points.

You can stack MILLIONS a year *tax-free* and never pay for first-class travel again.

If you’re not doing this, you’re missing out. Here’s why:

If you prefer the video version of this article, you can watch it here:

Whether you’re getting points or cash — they aren’t taxed as income.

Now even if you aren’t a big traveler, there’s still lots you can do.

A few ways I’ve used them:

✅ International 1st class flights

✅ Monthly staycation

✅ Furnished nursery

✅ Buying stocks (more on this)

Depending on the biz you run will depend on how easy this is.

The key is to optimize spending you already do, *not* spend more than you need to for the sake of points.

If you run paid ads then get ready to rack up millions per year.

My top cards

1. For ad spend: AMEX Gold card

You get 4X points per $ for ad spend up to $150K — that’s 600k points.

Big spender? No problem. You can get up to 6 (!!) cards for the same business for a max multiplier, which means 3.6 million points per year!

2. Chase Ink (2nd choice for ad spend)

You get 3X points for ad spend up to $150k — that’s 450k points.

✨ You can get 3 cards with them to multiply further, so that’s 1.35 M per year if you hit spend maximum on each.

Benefit deets: 👉🏻 https://lttlmg.ht/ink

*Quick caveat:

Getting multiple cards per business can be tricky depending on your rep and how well-versed they are. I was years into e-commerce before I learned about being able to stack cards (thanks @allenthird )

If you need a referral to a great rep, hit me up!

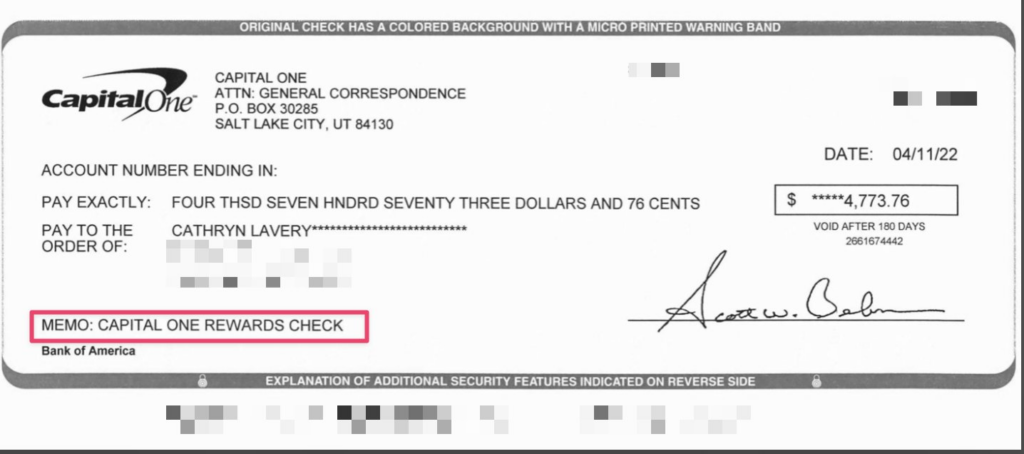

3. For cashback: Capital One Spark Card

2% cashback on all purchases. This can be cashed out anytime and is not 1099’d (tax-free as it’s considered a rebate)

Use for payments that don’t fall into categories with spend multiples.

Last check I got:

4. Schwab Personal Platinum

You’ll need this personal card if you want to cash out your AMEX rewards into cash. The rewards and benefits of this card are incredible & way make up for the $450 annual fee!

Too many benefits to tweeting, see here: 👉🏻 http://lttlmg.ht/platinum

Now once you stack these points, you can do a bunch of different things.

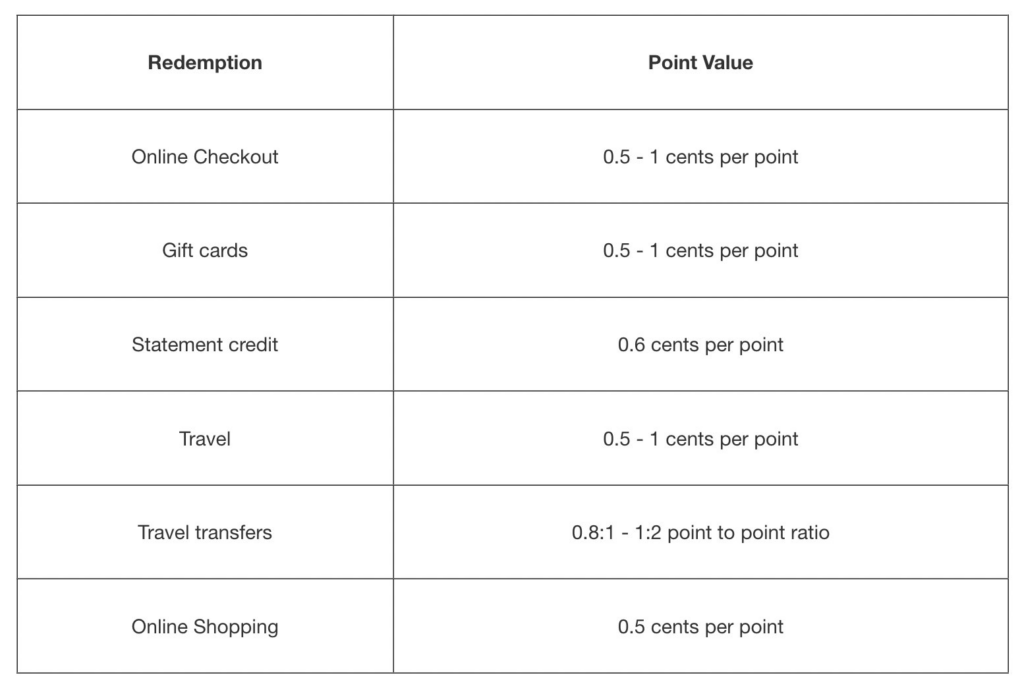

The best bang for your buck is travel.

Don’t use the travel portal tho — transfer out for the highest value. Can send to Southwest, Delta, Jetblue, Marriot, Hilton and more.

Here are the different redemption rates:

Compound points for further gains

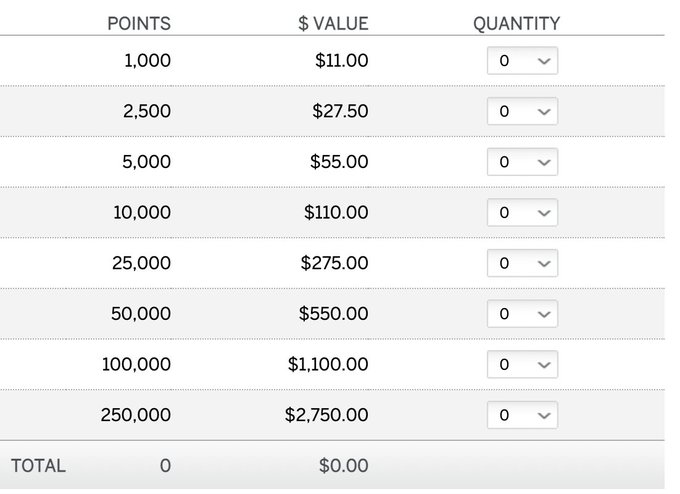

When you get the Schwab Platinum card you can exchange points for cash and invest in the markets (or transfer to your bank account.)

Here’s the exchange rate, this $$ will transfer to your Schwab investment account within minutes!

Don’t like or want to travel? No worries, you can exchange points for cash or redeem them for gift cards.

In 2020 during the pandemic, since I wasn’t travelling, I used points to furnish my house (and buy a Traeger) and recently bought all our nursery furniture at @westelm

Once you stack points, it starts to feel like monopoly money because they rack up so fast — then you can start doing fun things like…

- rewards for the team (gift cards, trips, etc)

- buying experiences for family & friends

- donate miles to charity

- paying off student loans

Summary:

- Focus on point multipliers and putting the right expenses on the right cards

- Remember you’re optimizing spend, not just spending for the sake of points.

- Pay off cards every month — don’t carry a balance or you’re going to be paying high APR.

Become a subscriber receive the latest updates in your inbox.